Bond yields are rising, creating wide-ranging ripple effects that impact the lives of everyday Americans. From influencing mortgage rates and altering investment strategies to even dictating the confidence level among home builders, the trend has both immediate and long-term implications.

The Significance of 5%

The yield on the 10-year Treasury bond has crossed the 5% mark for the first time since 2007.

In the constant noise of financial markets, the figure is a key psychological milestone that has broader implications for interest rates and investment returns.

A Wider Trend in Bonds

It’s not just the 10-year yield that’s growing; yields for the two-year note and the 30-year-long bond have also crossed the 5% barrier.

It indicates a broader trend in the financial markets, signaling higher borrowing costs.

What the Future Holds

Experts indicate that the next significant levels to watch for are 5.30% for the 10-year bond and 8.38% for 30-year home mortgages.

These projections are based on historical peaks, and breaking them could usher in more uncertainty.

Housing Market’s Unexpected Resilience

Contrary to what one might expect, the housing market has been resilient.

Despite a significant rise in mortgage rates, new housing construction actually increased by 7% last month, which could be due to a lack of available houses on the market.

Cracks in Housing Affordability

Though resilient, the housing market is showing signs of pressure. As mortgage rates double, affordability becomes a challenge.

New home prices are starting to stabilize, which could mean less frenetic growth ahead.

Declining Confidence Among Builders

Homebuilder confidence is waning. Confidence levels have hit their lowest since February, and their stock prices have slid nearly 19%.

This downward sentiment indicates caution in the housing industry.

Beyond Economics: The Family Perspective

Though financial factors are crucial, the decision to buy a home is also influenced by personal and family circumstances.

However, as interest rates rise, even these personal factors may have to be re-evaluated against the backdrop of higher costs.

Investing in Property Loses Shine

Higher bond yields make real estate investments less appealing. Why be a landlord dealing with property upkeep when you can earn more from a risk-free government bond?

A New Benchmark for Risk

Higher Treasury yields have set a new standard for riskier investments. Assets like stocks now have to offer even better returns to attract investors, which may not always be possible.

The Equities Dilemma

Treasury yields are now more attractive than stock dividends. For example, the yield from one-year Treasury bills is significantly higher than the dividend yield from the S&P 500 index.

The Complexity of Company Valuation

Rising bond yields also change the math when valuing companies. Firms with significant cash reserves may seem like bargains, but their earnings have to be scrutinized more carefully.

Stock Metrics Flash Warning Signs

Current metrics suggest that stock valuations are more expensive relative to their long-term averages. This could signal increased risks for stock market investors.

Corporate Bonds Gain Favor

With higher yields, corporate bonds are now better aligned with the targets of pension funds. This can make them a safer bet compared to volatile equities.

Shifting Investment Landscapes

The rise in bond yields may usher in a shift in investor behavior, with a move towards those perceived as more secure and less risky investment options like bonds over stocks.

Navigating Unpleasant Impacts

Rising yields could have a dampening effect on multiple asset classes, challenging preconceived notions of ‘safe’ investments and requiring new strategies for financial growth.

Be Aware

From the housing market to your investment portfolio, the rules are being rewritten. Being aware of these changes can guide your financial decisions in this evolving economic environment.

“America only has ONE NATIONAL ANTHEM”: Fans Outraged After Black National Anthem Is Sung at Super Bowl LVII Instead of American National Anthem

The NFL’s decision to include the performance of “Lift Every Voice and Sing,” often referred to as the “Black National Anthem,” at the opening of Super Bowl LVII has sparked severe online controversy. Here’s the full story. “America only has ONE NATIONAL ANTHEM”: Fans Outraged After Black National Anthem Is Sung at Super Bowl LVII Instead of American National Anthem

“Karma Strikes Back” – Russia Faces Its Largest Attack on Home Soil Since the War Began

Reports of drone attacks on Russian soil by the Ukrainian forces have escalated to the largest cross-border attack since the war started, with the important airport in Pskov becoming the latest victim. “Karma Strikes Back” – Russia Faces Its Largest Attack on Home Soil Since the War Began

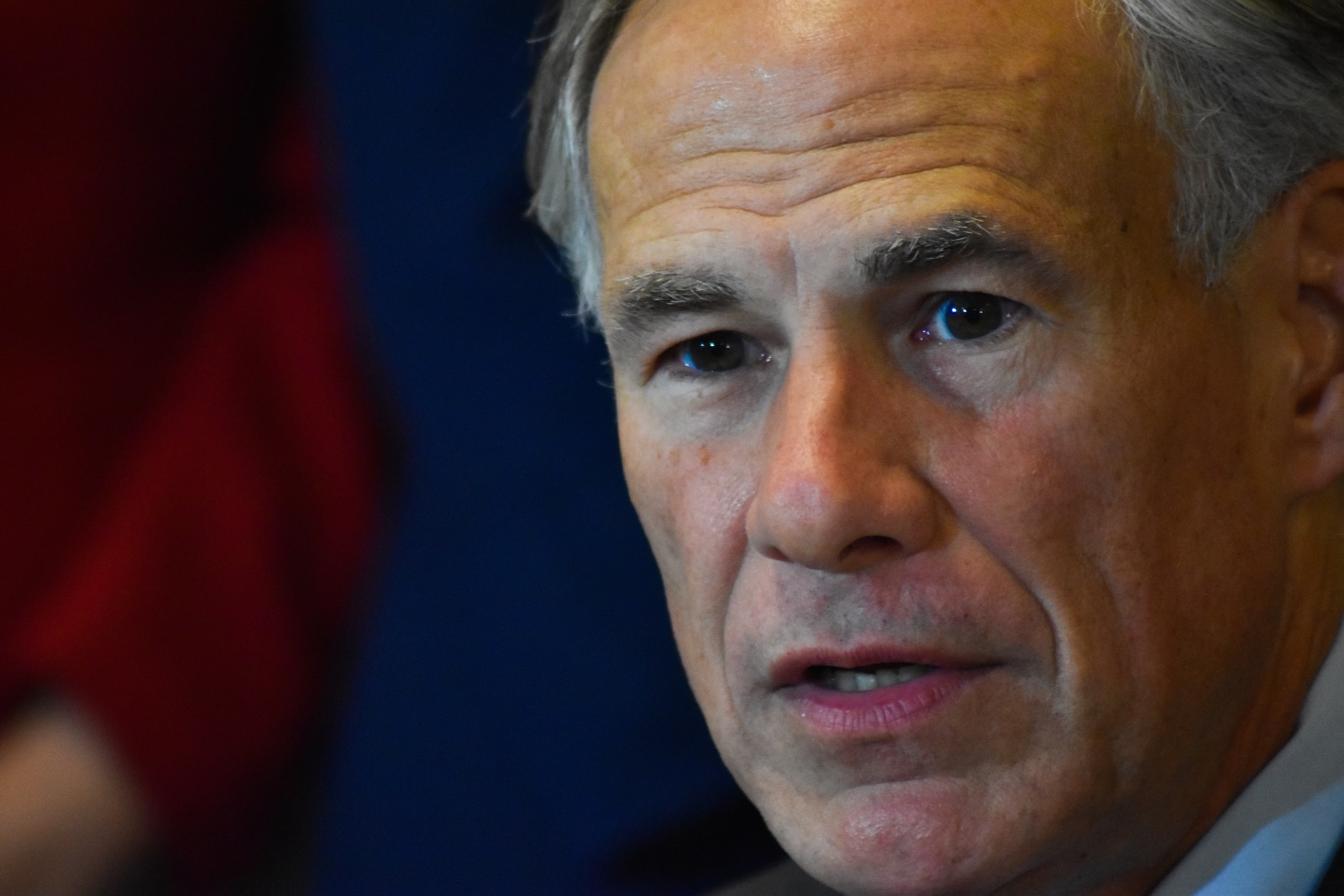

“Texas Is Doomed” – Federal Judge Delivers a Controversial Verdict, Gov. Greg Abbott Accused of Breaking the Law in Latest Legal Showdown

A federal judge has ruled that Texas governor Greg Abbott violated federal laws in his fight to keep Mexicans out. Now, the Republican may be up a creek without a paddle. “Texas Is Doomed” – Federal Judge Delivers a Controversial Verdict, Gov. Greg Abbott Accused of Breaking the Law in Latest Legal Showdown

They “Boxed All of the Black Children Together” – Florida Principal Threatens High-Achieving Black Student With Jail Time if Test Scores Don’t Improve

Bunnell Elementary School’s new principal, Donelle Evensen, attempted a unique strategy to address academic performance concerns, but it backfired spectacularly, sparking outrage and accusations of racial insensitivity. They “Boxed All of the Black Children Together” – Florida Principal Threatens High-Achieving Black Student With Jail Time if Test Scores Don’t Improve

Florida’s COVID Hospitalizations Soar as DeSantis Administration Urges People Under 65 Not to Get Newly Approved Boosters

Florida’s Covid-19 hospitalizations have surged to a post-pandemic record. Amid this crisis, Governor Ron DeSantis and his surgeon general’s controversial warning against COVID-19 booster shots has sparked intense debate and concern within the medical community. Florida’s COVID Hospitalizations Soar as DeSantis Administration Urges People Under 65 Not to Get Newly Approved Boosters

The post Americans Face Higher Monthly Mortgage Payments Amid Bond Yield Surge – What’s Next for Your Finances? first appeared on Mama Say What?!

Featured Image Credit: Shutterstock / fizkes. The people shown in the images are for illustrative purposes only, not the actual people featured in the story.

Mark Garro is an Aussie former CPA and corporate finance manager turned research writer. After more than two decades simplifying complex analyses for leading companies, including Goldman Sachs, Marks & Spencer, and Tabcorp, he packed up and moved to the Italian Riviera. Now he covers all things related to finance and equity research for a diverse range of publishers and syndicators around the world.